Big Sky Medical Expands Dallas-Fort Worth Footprint With Medical Office Building Acquisition

Big Sky Medical has acquired Richardson Medical Center I, a 118,472-square-foot medical office building in Richardson, Texas, from Pillar Commercial.

Bank of America provided the acquisition loan, according to Collin County records. Newmark represented the seller.

The property previously traded in 2019 as part of a portfolio transaction that also included the 120,000-square-foot Richardson Office Center II, CommercialEdge data shows. Pillar Commercial bought the duo from Buchanan Street Partners with healthcare conversion in mind for both assets. That same year, Methodist Richardson Medical Center purchased RMC II to accommodate the expansion of the hospital’s campus.

Originally completed in 1998, the two-story RMC I underwent cosmetic renovations in 2017. The property features 60,000-square-foot floorplates, a passenger elevator, controlled access and offers 720 car parking spots at a ratio of six spaces per 1,000 square feet. Its repurposing into a medical office building began earlier this year.

Located at 3101 E. President George Bush Highway, the property is some 20 miles Northeast of downtown Dallas. Medical providers in the surrounding area include the 334-bed Methodist Richardson Medical Center, Breckenridge Medical Plaza, Nova Medical Centers and Texas Health Neighborhood Wellness Cityline.

The Newmark team representing the seller included Vice Chairmen Chris Murphy, Robert Hill and Gary Carr, Senior Managing Director John Nero and Executive Managing Director Ben Appel, alongside Senior Managing Directors Jay Miele and Michael Greeley.

Big Sky Medical’s Texas Presence

Big Sky Medical has invested in more than 7 million square feet of health-care assets, valued at more than $2.2 billion. Earlier this year, the company expanded its Texas medical office footprint with several other acquisitions. The firm purchased Texas Tech Physicians of El Paso at Transmountain, a 110,465-rentable-square-foot medical office building in El Paso.

More recently, Big Sky Medical acquired a three-property portfolio totaling 110,636 square feet in metro Houston, from Caddis Healthcare Real Estate. The buildings are fully leased to Memorial Hermann Health System.

Source: CPE

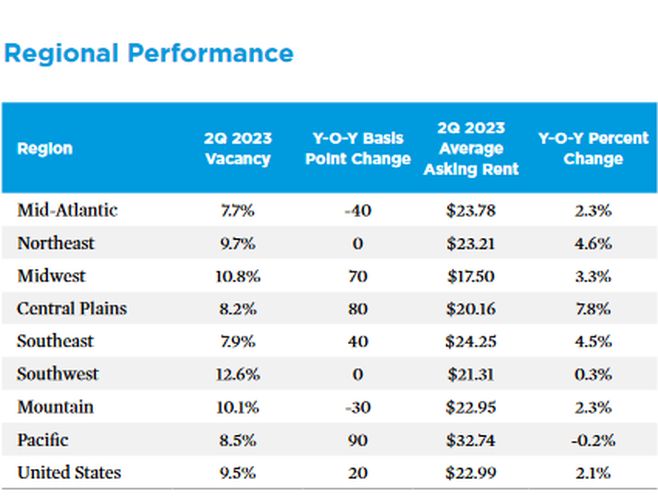

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”