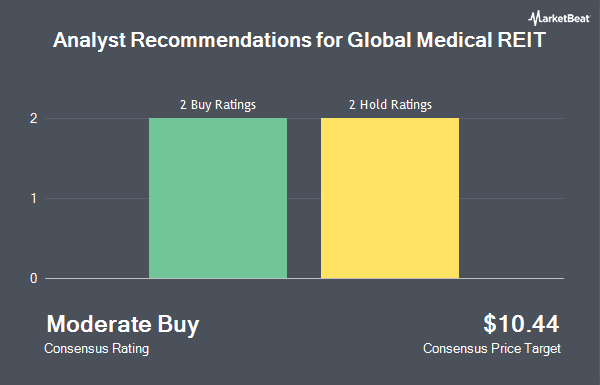

Zacks Investment Research upgraded shares of Global Medical REIT (NYSE:GMRE) from a hold rating to a buy rating in a research report just sent to investors.

Zacks Investment Research currently has $11.00 price target on the stock. According to Zacks, “Global Medical REIT Inc. is engaged primarily in the acquisition of licensed, state-of-the-art, purpose-built healthcare facilities and the leasing of these facilities to clinical operators. Global Medical REIT Inc. is based in Denver. “

Several other analysts also recently issued reports on the company. Janney Montgomery Scott downgraded Global Medical REIT from a buy rating to a neutral rating and set a $9.03 target price on the stock. in a research note on Wednesday, December 19th. B. Riley reissued a buy rating on shares of Global Medical REIT in a research note on Monday, November 12th. Finally, Boenning Scattergood raised Global Medical REIT from a neutral rating to a buy rating and set a $11.00 target price on the stock in a research note on Wednesday, November 7th. One analyst has rated the stock with a hold rating and six have given a buy rating to the company. The company currently has a consensus rating of Buy and an average price target of $10.43.

Shares of GMRE opened at $10.28 on Wednesday. The company has a market cap of $229.17 million, a P/E ratio of 19.04, a price-to-earnings-growth ratio of 1.25 and a beta of 0.58. Global Medical REIT has a 12-month low of $6.34 and a 12-month high of $10.47. The company has a debt-to-equity ratio of 1.66, a quick ratio of 0.09 and a current ratio of 0.09.

In other news, major shareholder Zh Usa, Llc acquired 1,111,111 shares of Global Medical REIT stock in a transaction on Friday, December 14th. The shares were acquired at an average price of $9.00 per share, with a total value of $9,999,999.00. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Insiders own 13.00% of the company’s stock.

Large investors have recently added to or reduced their stakes in the business. Schnieders Capital Management LLC bought a new stake in Global Medical REIT in the 4th quarter worth approximately $116,000. State Board of Administration of Florida Retirement System increased its stake in Global Medical REIT by 10.5% in the 4th quarter. State Board of Administration of Florida Retirement System now owns 15,526 shares of the company’s stock worth $138,000 after acquiring an additional 1,474 shares during the last quarter.

Advisor Group Inc. increased its stake in Global Medical REIT by 84.7% in the 4th quarter. Advisor Group Inc. now owns 17,184 shares of the company’s stock worth $153,000 after acquiring an additional 7,881 shares during the last quarter.

B. Riley Wealth Management Inc. bought a new stake in Global Medical REIT in the 3rd quarter worth approximately $251,000.

Finally, Wiley BROS. Aintree Capital LLC bought a new stake in Global Medical REIT in the 4th quarter worth approximately $262,000. 42.68% of the stock is currently owned by institutional investors and hedge funds.

Global Medical REIT Company Profile

Global Medical REIT, Inc operates as a development stage company that intends to develop and manage a portfolio of healthcare real estate assets and properties. The company was founded on March 18, 2011 and is headquartered in Bethesda, MD.

Click here To get a free copy of the Zacks research report on Global Medical REIT (GMRE). For more information about research offerings from Zacks Investment Research, visit Zacks.com.

Source: Fairfield Current