Why Medical Office Buildings Remain A Strong Investment Opportunity

According to JLL‘s latest research, medical outpatient buildings (MOBs) are on track for significant growth, with projections indicating a 10.6% increase in outpatient volumes across the U.S. over the next five years.

This surge is driven by an aging population with increasing healthcare needs and a rise in disease prevalence.

The report highlights a shortage in purpose-built MOB construction, especially in the Sun Belt, leading to steady rent growth and ongoing stability for both investors and healthcare systems. Technological advancements have supported a shift from inpatient to outpatient services, making treatments more cost-effective, safer, and less invasive.

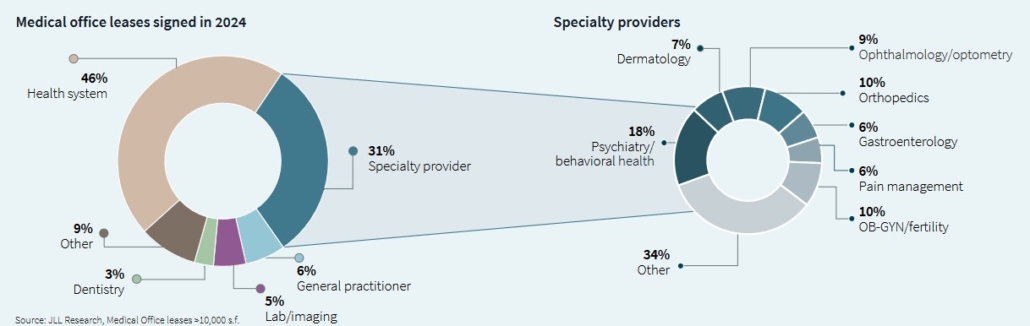

Healthcare systems are expanding their real estate presence by acquiring or contracting with physician groups to offer more specialty services. From 2022 to 2023, 16,000 additional physicians became hospital employees, and by 2024, health systems accounted for 46% of MOB leases tracked by JLL. Specialty providers, particularly psychiatrists and behavioral health providers, made up 31% of these leases, with psychiatrists accounting for 18% of the square footage.

Medical office leases signed in 2024. (Chart courtesy of JLL Research)

According to Savills and a 2023 survey by Definitive Healthcare, 60% of healthcare provider organizations plan to align their facilities and services with changing patient demands over the next two years. Employment in ambulatory healthcare is also expected to grow by 12% by 2028. As a result, many providers are now considering office and retail spaces near patients or hospitals. However, the conversion of high-acuity services like imaging into such spaces remains a challenge.

A Resilient Industry

Despite broader economic challenges, the medical outpatient building sector has shown remarkable resilience. Cheryl Carron, COO of JLL’s Work Dynamics Americas and president of the Healthcare Division, notes that while many real estate sectors are struggling with oversupply, MOB construction remains constrained. The fourth-quarter 2024 construction starts were at a record low of just 0.8% of inventory.

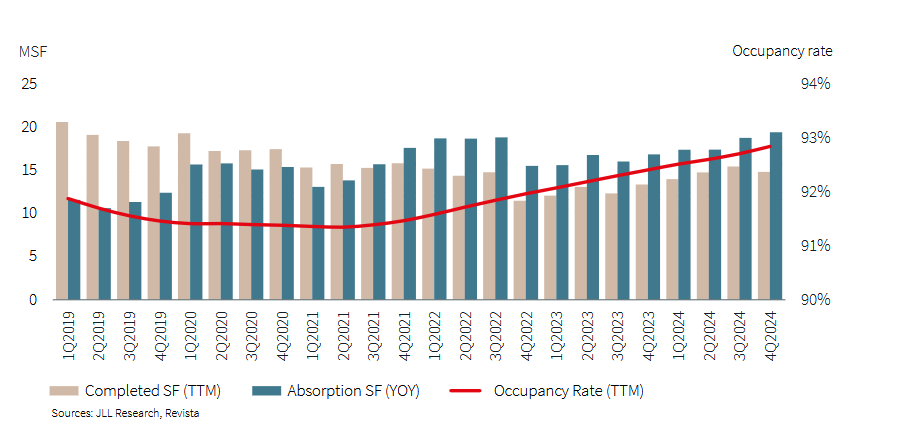

Rising occupancy and limited construction for purpose-built MOBs may cause increased spillover into adjacent property types. (Chart courtesy of JLL Research)

JLL’s research shows rising occupancy rates and steady rent growth for MOBs. By the fourth quarter of 2024, absorption rates in the top 100 U.S. markets exceeded 19 million square feet, marking a 15% increase from the previous year. Healthcare providers are expanding to meet growing patient needs, but they are doing so amid declining Medicare and Medicaid reimbursements and tight margins—averaging only 4.9% in December 2024.

As health systems face tight margins, optimizing facility efficiency is becoming critical. Carron explains that technology, such as artificial intelligence (AI), helps MOB operators make data-driven decisions to reduce energy and maintenance costs while ensuring a healthier environment for patients and staff.

The Role of AI In Improving Efficiency

AI and other technologies are also helping healthcare providers improve operational efficiency. Large language models, for example, can assist with patient interactions, such as prescreening and scheduling, reducing the workload on clinicians. Some AI platforms can perform up to 100 tasks, including making automated follow-up calls to patients after discharge, alleviating pressure from doctor and nurse shortages.

Slow Construction Amid High Demand

Despite high demand for healthcare services, MOB construction has been slow due to rising costs and high interest rates. Healthcare tenants are increasingly seeking alternative spaces as medical office availability remains limited. John Wilson, president of HSA PrimeCare, explains that the challenge lies in meeting rising healthcare demand amidst construction slowdowns and a shortage of physicians. With over 340 million people in the U.S. and just 1.1 million physicians, nearly half of whom are over 55, this shortage is only expected to worsen.

MOB occupancy rates continued to rise, reaching 92.8% by the end of 2024, up from 92.4% the previous year. Janet Clayton of Avison Young attributes this growth to a “flight to quality,” where tenants are increasingly willing to pay more for newer, high-quality medical office spaces. Rent for top-tier properties has risen faster than average, with some locations experiencing a 2.4% compound annual growth rate (CAGR) from 2019 to 2024.

Regional Performance And Expansion In The Sun Belt

The shift of the population to the Sun Belt is driving strong growth in markets like Miami, Orlando, Austin, and Tampa, where rent has increased by over 3%. However, established healthcare systems in markets like Northern New Jersey and Boston continue to perform well due to their strong brand recognition.

South Florida, in particular, has experienced significant demand from both healthcare providers and investors. Mark Rubin of Colliers notes that changes in Florida’s Certificate of Need regulations have facilitated hospital systems’ expansion in the region. Many major healthcare providers, including Cleveland Clinic, Baptist Health, and HCA, are expanding their presence in South Florida, leading to strong demand for MOBs. However, with limited availability of modern medical office buildings, developers are seeking land or repurposing traditional office and retail spaces for medical use.

Continued Investor Confidence In MOBs

Despite economic pressures like rising interest rates and inflation, MOBs continue to be a strong investment for many. Avison Young’s Blake Thomas states that although cap rates may temporarily expand, demand for medical office buildings will likely remain strong in the long term. Similarly, Igor Pleskov of Saul Ewing predicts continued rent growth and investor enthusiasm, especially if macroeconomic conditions improve, which could lead to a sharp increase in development.

With strong underlying fundamentals, the medical office market is well-positioned for future success. Investors looking for stability and growth in the real estate sector should continue to consider MOBs a reliable and profitable option.

Source: Commercial Property Executive

For more information contact us:

954.346.8200 x 201