Healthpeak Properties, Physicians Realty Trust Enter $21B Merger

Healthpeak Properties and Physicians Realty Trust have entered into a definitive agreement to combine in an all-stock merger valued at $21 billion.

The new company will operate a portfolio of 52 million square feet of health-care facilities, of which 40 million square feet represent outpatient properties in Dallas, Houston, Nashville, Phoenix and Denver. The partners expect to generate run-rate synergies of more than $40 million by the end of the first year, and $60 million by the end of the second year.

Healthpeak will also assume Physicians Realty Trust’s existing debt and will enter into a new five-year, $500 million loan at a rate of SOFR plus 85 basis points. The tax-free transaction is expected to close in the first half of 2024.

Transaction Details

Under the agreement, each Physicians Realty Trust common share will be converted into 0.674 of a newly issued Healthpeak common share. Healthpeak and Physicians Realty Trust shareholders will own 77 percent and 23 percent of the combined company, respectively. The new firm will pay an annualized dividend of $1.20 per share.

Barclays and Morgan Stanley & Co. are Healthpeak’s lead financial advisors, along with J.P. Morgan, Mizuho Securities USA, RBC Capital Markets and Wells Fargo serving as additional advisors. Latham & Watkins LLP is acting as legal advisor for the firm. Physicians Realty Trust worked with BofA Securities and KeyBanc Capital Markets as lead financial advisors, along with BMO Capital Markets Corp. Baker McKenzie is acting as legal advisor.

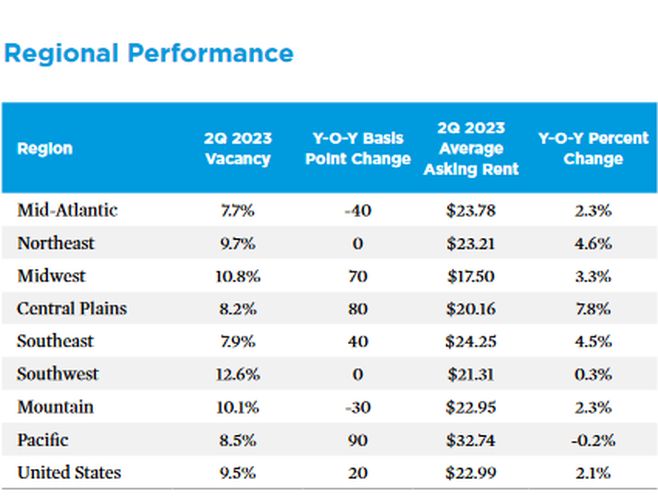

The medical office market is returning to more stable fundamentals, after having weathered recent economic headwinds, a recent IPA report on the matter shows. Medical office projects only represent 10.7 percent of the overall national office pipeline. The main challenge the sector’s expansion is facing is the health-care labor shortage, rather than supply-related obstacles.

Source: CPE

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”