Wiregrass Ranch Development Update In Pasco County Includes Orlando Health And Talks With Raymond James Financial

Wiregrass Ranch is a good barometer for patient money.

At 5,142 acres, the property, bordered by Bruce B. Downs Boulevard on the west, State Road 54 on the north and State Road 56 on the south, is slightly over 3 miles east-to-west. It is one of a dozen or so master-planned unit developments in Pasco County.

Wiregrass is entitled for 6 million square feet for office and medical office, 2.7 million for retail, and more than 1,000 hospital beds. Roughly half of that was built in 2019, a year before the pandemic when the Tampa Bay Business Journal last updated the master-planned development. The Porter family still owns and manages it. James “Wiregrass” Porter bought the property in 1937 and the Porter family has lived and worked on it since 1946. It wasn’t until 1972 that the family sold its first major portion on the northern edge of the property to build Saddlebrook Resort.

The Porters have demonstrated a careful approach to stewarding the land based on how it could best meet the family’s needs and enrich the community, owner JD Porter told the Business Journal in 2019.

“That patience hasn’t budged,” Porter said in a Business Journal interview alongside development partner Wiregrass COO Scott Sheridan last month. “Being picky, or in other words, clear on its community goals, has meant saying no to many potential users.”

Through Covid, there have been changes and newcomers. Raymond James Financial, which planned up to a million square feet of office space at the heart of Wiregrass, is still in limbo. But Orlando Health should soon break ground on a first $100 million phase for a hospital — adding to already fierce East Pasco competition with BayCare (a new hospital about to open) and AdventHealth, which was the first major Wiregrass project 10 years ago. Both sit a short distance from each other on Bruce B. Downs Boulevard. In Wiregrass, there are also two new standalone projects. Florida Cancer Specialists will build a $40 million, 60,000-square-foot facility to employ 240 people and there are other big users close on deals.

The following conversation has been edited for brevity and clarity.

Tampa Bay Busness Journal: In the fall, you brought back some of the Wiregrass Mall land and have been clearing it for phase II. Tell us more.

James Porter: We bought that back from QIC, the Australian fixed-income fund. And [in the mall], we’ve given them office entitlements. They’re doing a WeWork type of space in the old Forever 21 space. We always have first right of refusal; or we control the entitlements, typically both to make sure that we can maximize the value not only of what we’re selling but down the road, too, to make sure that the market keeps up. I don’t know of anybody else that does that, but it’s actually played out very well and helps us manage the project’s expectations.

Tampa Bay Busness Journal: You’ve long been deliberate about maintaining a high bar for what comes to Wiregrass.

Scott Sheridan: [The family] has the ability to be patient and make sure that they got the right partners involved in the project right. We’ve turned quite a few things away. Either it’s not the right time at the right fit for us, but we’re constantly making sure that we’re bringing high-quality brands and identity to Wiregrass. It is what JD and I and the family focus on.

James Porter: Some people are better at certain things than we are. We’re trying to learn as we go. Many of these [real estate holding] companies could be forced into a position and have to unload [property], or the market changes and they have to show 30% returns. We don’t have to do that. We stay in the game and manage that expectation. We’ve got 60% left of the project to build. We don’t need a failure.

Tampa Bay Busness Journal: What else is news?

Scott Sheridan: You touched on Orlando Health. The size and scale of what they’re looking to develop will be impressive. Their first phase will be similar in size and scale as existing AdventHealth [Wesley Chapel hospital]. This will be their up to 300-bed hospital. It will be the hub of their spoke throughout the Tampa Bay area. So they’ll have other satellite facilities that will probably feed this hospital. But this is ground zero for their hospital presence.

Tampa Bay Busness Journal: For Phase I, it’ll be close to $300 million?

James Porter: Yes. And at build-out we’re looking north of $750 million using today’s numbers. That’s impressive to me. Health care is definitely happening in the area. That world’s changed a whole lot. But seeing the impact that [AdventHealth Wesley Chapel hospital] had locally, all the hype with BayCare coming in – it’s set to open a couple of weeks – and then seeing [Orlando Health] come in and build something bigger than Advent, which has been open eight years. There’s definitely demand out there, but it’s a changing ballgame. They’re looking at numbers that we don’t, so we’re excited about that side of it.

Tampa Bay Busness Journal: With no certificate of need rules, there’s the Wild West feel to the marketplace competition. But they have confidence.

Scott Sheridan: They are a pretty astute group, and they are looking at many demographics. They want to protect their revenue streams, obviously. So they’ve done exhaustive research about the growth that’s already in Wesley Chapel but also what’s happening [broadly in the market]. We thought it was obviously important to get some separation for them and put them on S.R. 56 [an east-west corridor], which makes a lot of sense as opposed to Bruce B. Downs [north-south corridor to the west, with two hospitals within a mile of each other]. Clearly, Bruce B. Downs is adequately covered right now.

Tampa Bay Busness Journal: What’s the status of the Raymond James project?

James Porter: Their world completely changed. When we sat down before Christmas, they usually had 7,400-something employees in St. Pete. I think their best day since the start of Covid was just south of 1,400. Everybody’s feeling that pain because everybody tells me they’re producing at home like they should until they see the numbers and then they’re not. So they’re trying to figure out how to get people back in.

That is the general theme that we’ve heard from everybody out there. It’s an eye-opener with Raymond James. There’s another office group [we talk to] where they have 200,000 square feet, and they have had three people showing up for over a year now. And they are still paying up. How do you force somebody’s hand? That’s one in-common thing. How do you get people back? We’ve had active discussions with Raymond James.

Scott Sheridan: They’ll be out there.

Tampa Bay Busness Journal: In some form. To the extent you can, take us into those conversations.

Sheridan: They may have 1,000 employees that live closer to [its Wiregrass site] than they do to Carillon and their existing employees.

James Porter: They have 800 or something people within 15 minutes of their site in Wiregrass. That’s a significant presence. But at the same time, how do you juggle that with how many of the 800 are actually showing up? That’s what Scott and I are feeling about it. I would rather them not do anything — I don’t want them to be oversized or undersized. They don’t need to have an empty building.

Scott Sheridan: So is it 50,000 [square feet] or 100,000? We’re not quite sure. They’re not quite sure. We’re focused on working through that with them here next few months and trying to understand that better.

Tampa Bay Busness Journal: If you do get any of that land back, what’s out there that works for you?

Sheridan: That’s a good question. That being a major employment location for office, we’re having active conversations with many folks about that. There is not a ton of 300,000 or 400,000-square-feet guys anymore. We’ve got some office projects we recently permitted on the 56 corridor that we may consider bringing to market just as a test case and seeing what kind of demand is out there. We get many calls from folks that need five, 10, or 15,000 square feet. We think there’s an opportunity for a corporate-type park there, maybe a mixed-use with several retail and restaurants with it as well.

James Porter: We’re in a position to do that differently because we’re not just worried about that building. We can control 4,000 acres around it. We’re in the unique position to be able to program that with localized shops that people want to go to during lunch or businesses like that. I’m more excited about talking to 15 or 20, 10,000-square-foot users than a big 200,000-square-foot user because you can’t lose them all at once.

You’re going to have your ebb and flow. But if it’s going back to that, I think that really creates a better sense of place than this one major 800-pound gorilla that has got a lot of weight and can threaten to leave at times and do that.

Tampa Bay Busness Journal: That’s more diversified and makes it easier to navigate economic cycles. What does that trend say about the state of the Pasco economy now and where you sit within it? There is a drumbeat to land high-skill, high-paying jobs. And we are thinking a lot about Moffitt’s goals and the need for thousands of scientists.

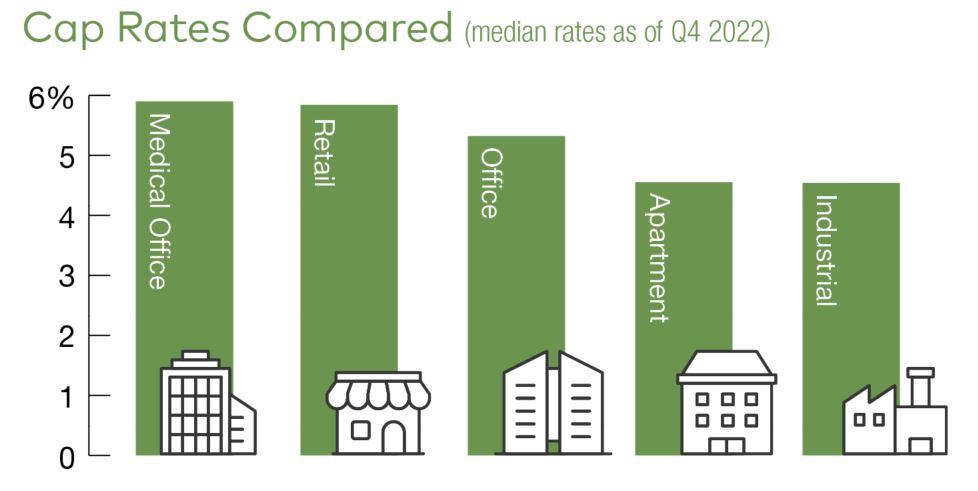

Scott Sheridan: Health care is a major driver. Like Moffitt, Advent and Orlando Health, they’re major employers. Those are typically significant-wage jobs. The county endeavors to get more lighter industrial and some of that stuff happening, and they’re having some success with that. But on a per square foot basis and tax basis and an employee revenue basis, they’re not even close to being as strong on getting more class-A office. Given our location, it’s really the economic hub for Wesley Chapel and Pasco, whereas some of that smaller office or industrial stuff on the outskirts, on S.R. 52, all makes sense. We we think that’s going to be great, but that’s not who we are. That’s why we talk more about whether we bring some of the first real class A office in the submarket here. There’s been some stuff up and down 54, and they’re struggling to get that occupancy. But costs have been so high that rent rates can’t quite get there. And so pushing the high 20s, and low 30s on rent is not uncommon. But in Wesley Chapel, it has been a little bit of a challenge.

Tampa Bay Busness Journal: More Class-A office has been a big part of the future vision for Pasco.

James Porter: It’s weird for me to look at it because you talk about Moffitt. It is exciting. But we talked to Moffitt before Advent [Hospital Wesley Chapel] was even a thought. So I’ve seen what can happen. We were cutting edge with Advent. I think Moffitt pulled back and said, ‘hey, what’s out there?’ Now, we’ve got three other hospitals that will already open before them and they are already leasing out 50,000 square feet at Advent [Wesley Chapel]. I’ve got Moffitt at Wiregrass right now. Finally, everybody’s playing catch up and seeing what we saw, what the market recognized in us eight or 10 years ago. Fast forward from there, we’re seeing now that Pasco’s never really had the chance to see what it could be when it grows up. Two things happened. I think a lot of the big builders come in and they swiped up everything that could be good. They’re paying great numbers, but it never has a chance to see if that would work. But we’re in a unique position to do that. We got it structured where we haven’t sold all the residential. I could before we finished our meeting. I could pick up the phone, and we could sell it and it could be a really incredible number and it doesn’t matter to us. We will continue to roll it out and make sure it’s successful.

Now, we’ve got the medical office. Now let’s take the first spec office to market and see what’s out there. The demand is clearly there, but nobody’s really taken a – I wouldn’t even say it’s a risk. The way that I look at it, it’s not a risk to us at all. I think other people can look at it, especially with the costs, but for us, it’s been more of that patience game and you don’t get class-A office before rooftops. We were looking at a mall, a college, a high school, and a hospital before there was a rooftop. But I think you’ll see that in the next year.

Scott Sheridan: To your question about the larger Pasco economy, you’ll see some of that along right at the interchange with the Suncoast Expressway. That’s where the commuting traffic is and that’s what it makes a little more viable, and here [at Wiregrass]. Nobody else has in East Pasco what we’ve constructed and even the employers that we’re talking to, even Raymond James and those folks tell us, ‘your infrastructure, your great schools, your great quality housing, dining, all these types of things make me want to bring employees here.’ Now we’ve got all those pieces of the puzzle. Florida Cancer Specialists is building a 60,000-square-foot facility.

Tampa Bay Busness Journal: What’s the next step for Orlando Health? When does it break ground?

Scott Sheridan: They’ll break ground this year. We’re in for some permitting right now with them. And they’ll be in for some permitting for their first phase later this year.

James Porter: Some of the conversations we’ve had in the past, we talked about the thoughtfulness of, man, we just got Orlando Health. The town center is right next to it. Everybody talks town center. It’s usually a Publix and a laundromat anywhere in Pasco. There’s not that sense of place. Most of the time, they fail because there’s no daytime traffic. Or it’s a community where people aren’t going. We’ve created, where, across the street, you’ve got people playing some our $750,000 for A 1,700-square-foot house. They’ve got disposable income. We put an employer with 2,500 or 3,000 jobs next to the town center. Now we’re ready to go. So it’s not just for one deal.

It’s almost a puzzle, getting one big piece and putting it somewhere. And then we start putting in the little pieces around it, so there is that success. It’s being thoughtful of one deal that breeds that success across the project. It takes a while. But at the same time, we don’t worry about failure. We don’t worry about stuff not actually happening.

Source: Tampa Bay Business Journal