New Clermont Project With Restaurants, Shops, Medical/Office Space In The Works In Florida

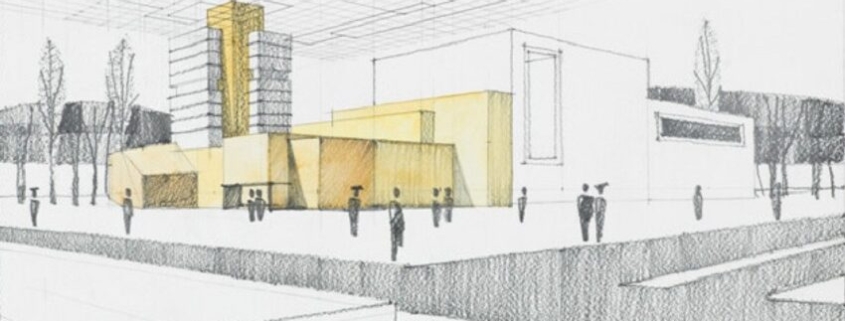

A 16-building, mixed-use project with roughly 100,000 square feet of retail, restaurant and medical/office space is in the works for a fast-growing Lake County corridor.

Winter Garden-based Schmid Construction Inc. is the applicant and developer behind the Cross Ridge Exchange project, to rise on 11.3 acres along U.S. Highway 27 in Clermont.

Schmid Construction Principal and CEO John Schmid confirmed to Orlando Business Journal that the firm has the land under contract from Lake Wales-based Lost Lake Reserve LC and will be the general contractor for the $14 million project.

Cross Ridge Exchange will rise nestled between an existing BJ’s Wholesale Club and Walmart Supercenter.

“That’s really the strength of the project,” Schmid said, referring to the location.

The development will feature at least 50,000 square feet of retail and restaurant space across nine buildings closest to U.S. 27, in addition to at least 39,000 square feet of medical/office space across eight buildings toward the property’s back end, along Cross Ridge Road.

Building sizes are not yet final, and Schmid said they are pursuing permission for up to 115,000 square feet to have some buffer if the project needs to be larger.

Cross Ridge Exchange was given approval from Clermont’s planning and zoning commission earlier this month and next will go before its city council for its conditional-use permit.

Schmid said site work may start within the next few months and the goal is for vertical construction to begin in the first quarter of next year, with an anticipated delivery by the end of 2023.

Schmid Construction will serve as general contractor, and subcontractor opportunities will be available. Opportunities for site work may be put out to bid within the next few months and construction opportunities should be put out to bid early next year.

Orlando-based First Capital Property Group is handling leasing for the development, with senior sales and leasing associate Trey Gravenstein telling OBJ it has attracted good activity and two letters of intent so far after going live July 27.

Source: OBJ