When it comes to location identification for development, you have to think creatively. In a highly competitive market like Milwaukee, mixed-use projects offer a great opportunity to showcase creativity, take advantage of complementary uses and drive tremendous value for clients and investors.

The success of a mixed-use project lies in location. A high-profile location will help attract businesses, which then helps build traffic. Ideally, you want to think outside the box to generate repeat visits with businesses that will help sustain that traffic. An innovative mix of retail, restaurant, hospitality, office and even healthcare can greatly enhance a development.

Mixed-use retail developments create new opportunities for healthcare projects. Health systems and physician practices are choosing to prioritize locations they may not have previously considered. There’s been a significant expansion of and increased focus on the outpatient ambulatory environment. The trend of developing specialty outpatient facilities, ambulatory surgery centers and micro-hospitals continues to gain momentum and allows for expansion to remain competitive while maintaining efficiency.

An outpatient facility brings traffic. Finding a high-visibility location where customers are already engaging increases the convenience factor. Built-in traffic drivers like restaurants and retail help with trip assurance. For example, after wrapping up a clinic appointment, you can stop for food, or pick up something at a retail store. Zeroing in on what the consumer wants and then making it easy for them to achieve that is the key to success.

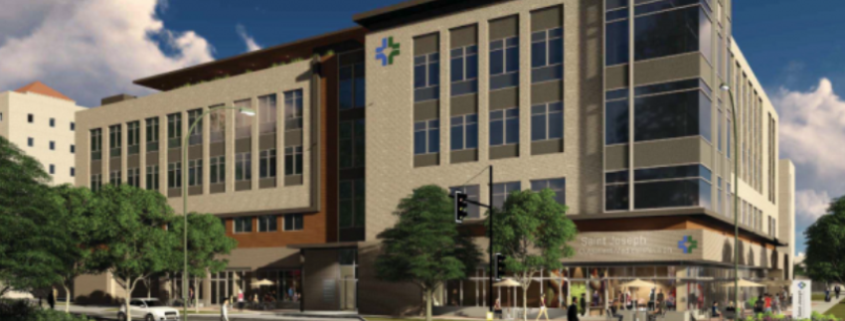

Case study: ProHealth Care

ProHealth Care, a community-based healthcare system in Waukesha County in southeastern Wisconsin, approached Irgens for a new project in the Milwaukee suburb of Brookfield. ProHealth Care offers a full range of services from primary care and specialty care, hospital care, rehabilitation care, home and hospice care to fitness and wellness services. The company had a previously under-performing site, and after learning more about the goals for this new development, Irgens presented them with an alternate opportunity at The Corridor.

The Corridor is a 66-acre, horizontal mixed-use project that includes retail, restaurants, hospitality, healthcare, office and fitness and wellness space. The location offers great visibility from I-94 in a heavily trafficked area in Brookfield.

Irgens brought this project to ProHealth to help reposition its services from a lower profile and less-valuable location to a highly sought-after retail corridor in a richly developed demographic market. The strategically important location made sense, and ProHealth Care took advantage of the opportunity. The Corridor offered a high-profile site with multiple access points. A number of growing and first-to-market businesses chose to locate there, including Dick’s Sporting Goods, Portillo’s and Life Time Fitness.

Irgens moved quickly on the 50,000-square-foot building for ProHealth Medical Group at The Corridor. Immediately following lease signing, Irgens completed the building design and expedited the entitlement process to bring the project to occupancy within 11 months. Securing the site and getting ProHealth to market quickly gave the company a competitive advantage.

Consumers expect to find healthcare delivered in a more convenient location. If it’s not convenient, consumers will not engage because they make decisions based on ease. Health systems are beginning to understand this.

Successful healthcare development through strategic and trusted relationships will serve companies well. Irgens has developed several projects with ProHealth Care over the years. Trust was an important factor in having ProHealth Care consider the opportunity at The Corridor and immediately recognize its value.

Successful real estate developments are close to where people live, work and play. Proximity to mass transit and other amenities like grocery and retail stores are key factors to that success. Healthcare plays into this as well, becoming another key element for a quality mixed-use development, positioning an organization in a new area to create a new avenue for care delivery in a convenient, consumer-oriented setting.

Source: RE Business