Medical Office Building Sector Remains Stable, Attractive

Having weathered recent headwinds, the medical office building sector is seeing a return to more stable property fundamentals, according to a new Medical Office National Report from Institutional Property Advisors.

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”

Rising construction costs have helped to prevent overbuilding, with medical office space totaling only 10.7 percent of the overall office pipeline. IPA points to a very different factor limiting the product type: “… the sector’s main challenge is not supply, but rather a health-care labor shortage.” The pandemic has exacerbated an existing worker shortage that may hinder practices seeking to expand to meet future medical care demand.

High interest rates have affected both deal flow and pricing. Transaction velocity in the MOB sector fell by more than 30 percent over the 12 months that ended in June.

“The average sale price has begun to recalibrate accordingly,” IPA reported, “dropping 3 percent from the high reached in 2022 to $295 per square foot for the yearlong span ended in June.”

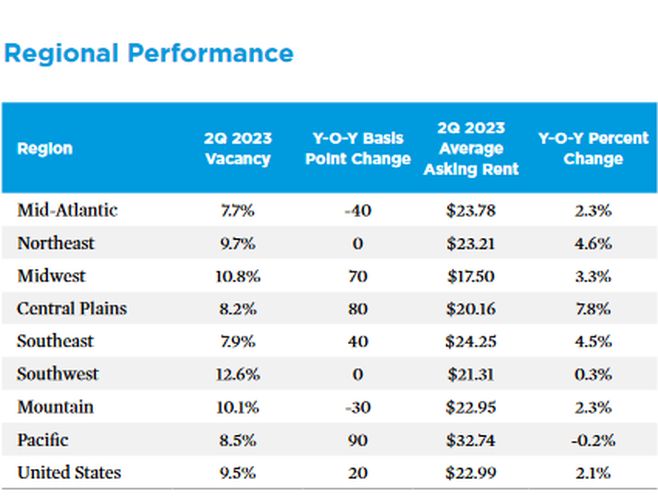

MOB regional performance. Table courtesy of IPA Research Services; Bureau of Labor Statistics; Federal Reserve; Centers for Medicare & Medicaid Services; Moody’s

On top of that, a paucity of transactions, especially those of $10 million or more, have hampered price discovery.

Geographic Diversity

A variety of regions across the country split up top marks for different performance metrics.

The Mid-Atlantic and the Southeast (driven by Florida) lead in terms of low average vacancies, and the former is tops for a falling overall vacancy, having dropped by 40 basis points year-over-year. The Mountain States too have seen a sizable fall in overall vacancy, by 30 basis points.

Asking rents are highest (at $32.74) in the Pacific region, and lowest in the Midwest ($17.50). Rental growth was far and away the highest in the Central Plains region, with 7.8 percent year-over-year. The Northeast (4.6 percent) and Southeast (4.5 percent) were essentially tied for a distant second place.

Source: Commercial Property Executive