Why Experts Say Now Is The Time To Buy Medical Office Buildings

Despite all the doom and gloom of the news about the office sector, one component remains strong: medical office buildings.

It is buoyed by a stable clientele, long-term leases, and a slow pace of new entries. Even better, the buildings’ tenants can rely on a steady flow of customers in need of care. The flow has even increased as a result of passage of the Affordable Care Act, an aging population, and advances in medical technology that enable more procedures to be delivered in lower-cost, more efficient outpatient settings.

And investors are paying attention, according to the just-released 2024 report “Emerging Trends in Real Estate” issued by PWC and the Urban Land Institute. In total, the U.S. healthcare industry represents 17% of GDP. Outpatient care and care provided in medical office buildings is a significant share of the total.

“The sector has also been shifting to a retail mind-set, where hospital systems and providers look to attract new patients and build market share in new areas, contributing to the increased demand for high-quality medical space,” the report noted.

For landlords, medical offices are practically ideal tenants. They may sign leases of 15-20 years and are likely to renew them in order to remain close to their patient base.

“Typically, the renewal rate is 80% or more and rent growth generally ranges between two and three percent a year,” the report stated. “These dynamics have helped the medical office sector maintain healthy fundamentals throughout economic cycles.”

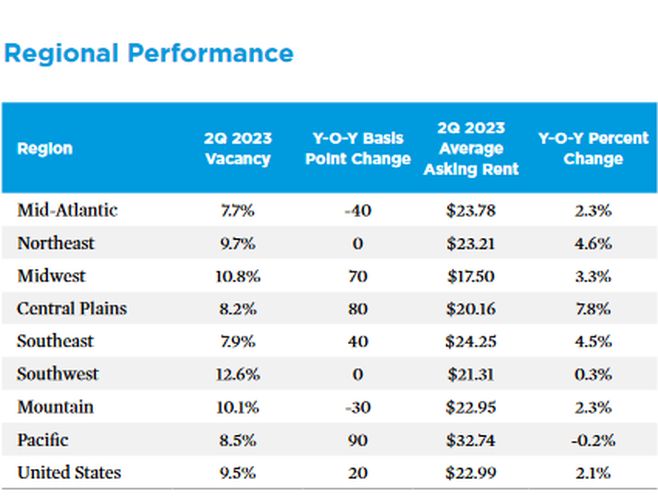

Furthermore, occupancy has risen in recent years as space absorption has outpaced square footage added. The occupancy rate was 92.8% in 2Q 2023.

Nevertheless, “after reaching peak investment volumes of $30.2 billion (annual basis) in the third quarter of 2022, medical office transaction volume has since slowed to $20.2 billion as of the second quarter of 2023,” the report noted.

But while it has slowed, it has not stopped. Transaction volume totaled $4.7 billion in the first half of 2023 – lower than the $10.1 billion sold in the same period of 2022, but consistent with levels seen from 2018 through 2021. Few distressed sales have occurred. The report attributed the lower transaction volumes to a “disconnect” between sellers and buyers.

“But the stage is set for increases in volumes when buyers and sellers can better come together and the capital markets begin to normalize,” it said. “The medical sector is large and investable, comprising over 1.5 billion SF of current inventory. A substantial amount of opportunity exists for investors to take on more ownership.”

By square footage, over half the sector is owned by users – hospitals, providers, and physician groups. The rest is owned by REITs and private investors who use a variety of structures and vehicles to make it work, the report noted. Institutional investors often invest through operating partners, frequently vertically integrated regional or national firms that specialize in the development, acquisition and operation of medical office buildings and often have deep relationships with hospitals, health systems and physician groups.

Speculative development is rare, leaving inventory to increase at a pace driven by tenant demand, currently around 1% and seldom rising more than 2% a year.

The opinion of experts surveyed for the report is largely favorable. Some 48% recommended buying, 46.4% said hold, and just 5.8% said sell. And while 34.3% considered the sector overpriced, that was a much smaller percentage than viewed suburban and central-city offices as overpriced. Some 61.4% thought medical offices were fairly priced and 4.3% thought they were underpriced.

“The medical office sector has matured into an attractive and stable CRE asset class of its own,” the report concluded.

Source: GlobeSt

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”

There was a COVID-driven fall-off in medical visits in 2020, but this has “generally dissipated,” the report states, adding that “medical office vacancy has stayed between 8 and 10 percent and, in June 2023, the rate was just 50 basis points above the long-term average.”