A confluence of factors is feeding demand for healthcare real estate, including robust domestic demand, related interest from investors outside the U.S. and relatively easy access to capital.

The rapidly ascending ambulatory sector—one of several trends impacting the undulating healthcare real estate landscape—is feeding a booming medical office market. That, in turn, has drawn increased foreign investment and loosened the purse strings on a vast supply of capital that also has fueled construction and mergers and acquisitions.

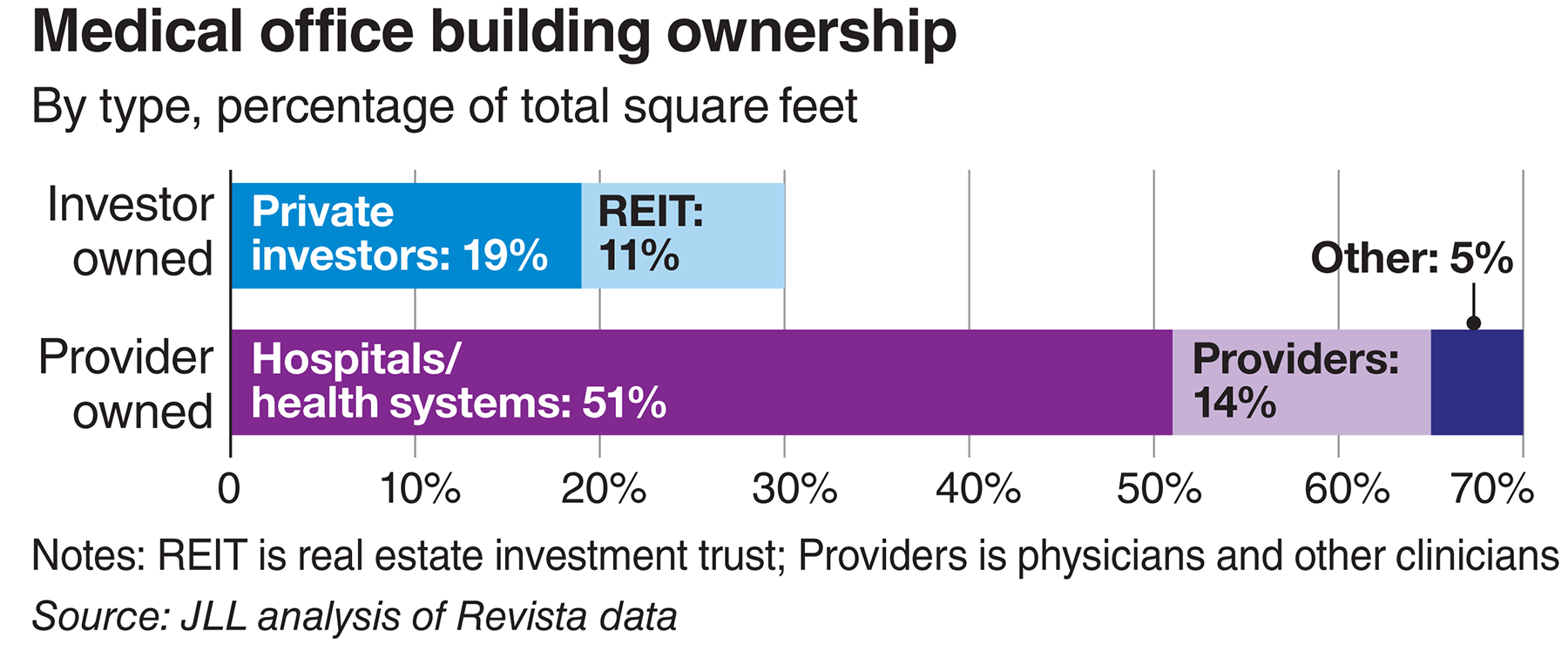

“While foreign investment isn’t yet significant enough to dictate a change in medical office pricing or supply and demand, it could eventually shift market dynamics,” said Hunter Beebe, a managing principal at healthcare real estate advisory firm Healthcare Real Estate Capital. “There is a lot of capital pursuing healthcare real estate beyond foreign—private equity, REITs, domestic—the list goes on.”

Care Transformation Spurring Demand

A sweeping transformation is taking place in terms of where healthcare is being delivered. Vast hospital footprints are giving way to more convenient outpatient space, as consumers and payers seek affordable and accessible care.

The number of outpatient facilities jumped from 26,900 to 40,600 between 2005 and 2016, according to a recent report from commercial real estate firm CBRE.

Meanwhile, health systems are looking to keep pace with new competitors aiming to draw people from hospitals. Reimbursement pressures and capitated payments are pushing people out of expensive care settings while technology is enabling more complex care in outpatient facilities and the home.

Those factors drove many systems to adopt a change in approach, such as Vanderbilt University Medical Center‘s transformation of about half of a struggling 900,000-square-foot Nashville shopping center into an outpatient hub.

Revenue has followed these trends, according to data from the American Hospital Association. Hospitals‘ net outpatient revenue was $472 billion in 2017, coming close to equaling inpatient revenue, which totaled nearly $498 billion. This has fueled investment in healthcare real estate domestically and abroad.

“Twenty years ago, healthcare real estate wasn’t carved out as a separate sector,” said Jeff Calk, a partner at law firm Waller Lansden Dortch & Davis. “Demand has increased with the evolution of the industry. Now portfolio managers want to have 8% in healthcare real estate, 12% in general office and 32% in hotels.”

“That makes sense given the outlook of other asset classes and markets,” said John Claybrook, a partner at Waller.

More people are working from home, which is softening the office market. Retail’s upheaval isn’t doing the sector any favors. A slumping oil and gas market as well as geopolitical turmoil involving what is the not-so United Kingdom, the eurozone and the Middle East have caused investors to look elsewhere.

“In comparison, healthcare real estate looks stable and profitable,” Claybrook said.

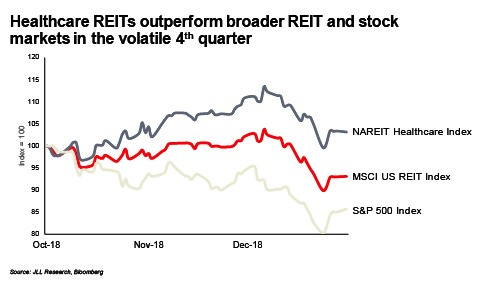

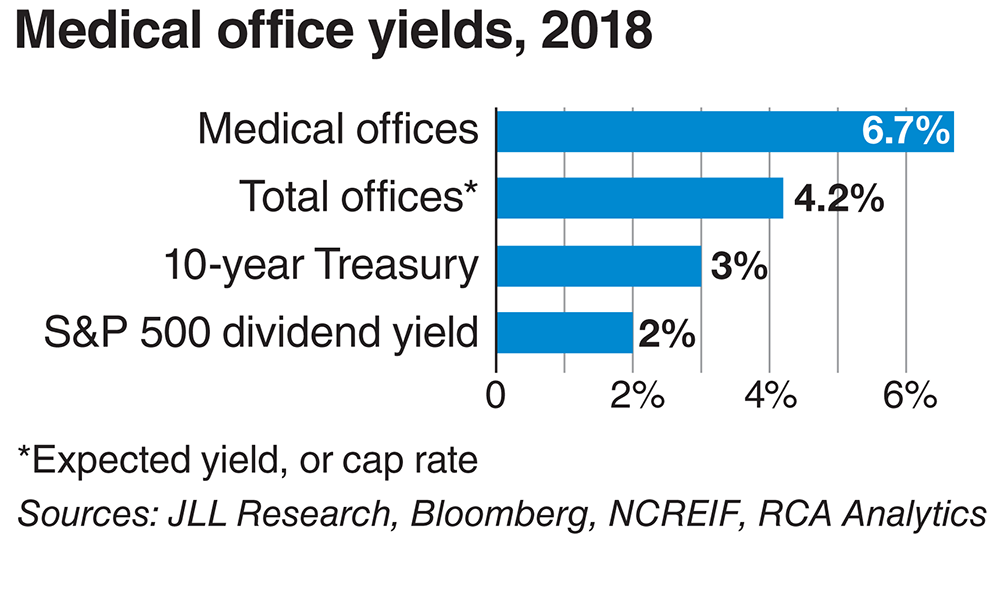

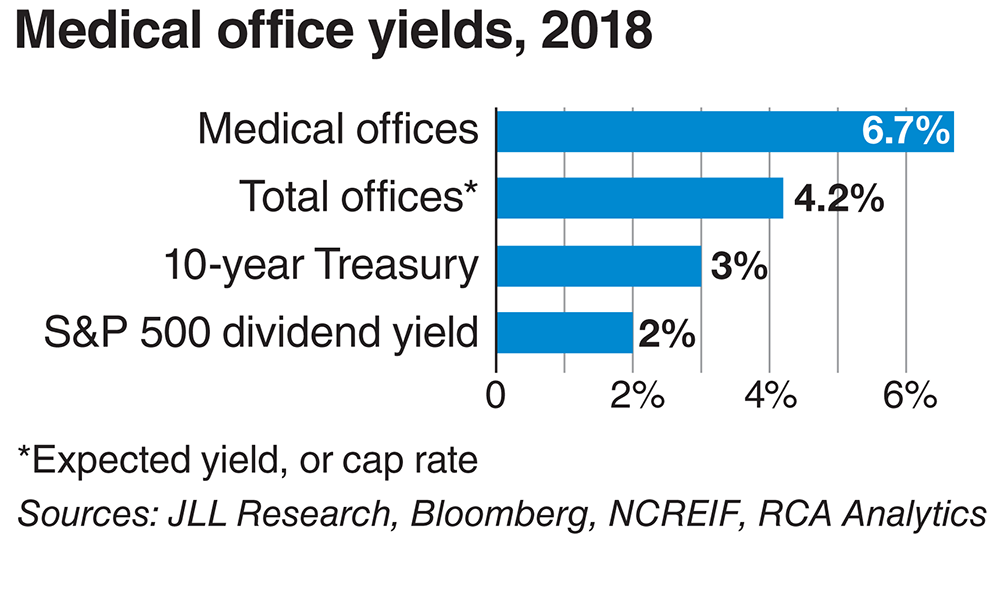

Weighted average occupancy for medical office space rose from 90.4% in 2009 to 92.3% in 2017, according to data from real estate firm JLL. Medical office returns offer a 2% premium over the broader office sector and are more than double the 10-year Treasury yield, according to JLL. That will likely continue as the aging population requires more care.

Catching The World’s Attention

The trends have stoked interest from foreign buyers, including China and Japan, who will continue to seek operation and care-delivery expertise in a variety of subsectors, according to PricewaterhouseCoopers‘ latest US Health Services Deals Insight report. More global interest is directed toward medical office properties, which could boost a prime seller’s market for healthcare organizations looking to offload their real estate, experts said.

“While institutional investors like pension funds or insurance companies in Asia, Canada and the Middle East have been surveying the medical office sector for some time, that interest has only just recently translated to more deals,” Beebe said.

“We have seen a noticeable increase in interest from foreign investors in the U.S. healthcare real estate market,” Beebe said. “Foreign investors have been behind the scenes of medical office deals packaged with major U.S. health systems and real estate investment trusts. They have also invested directly or acquired major equity stakes,”

Most of the interest is stemming from the Asia-Pacific region, at 21%, followed by 16% in Europe, the Middle East and Africa, and the Americas at 15%, according to CBRE’s Global Investor Intentions Survey.

“What healthcare investors like is the stickiness of tenancy,” said Christopher Bodnar, vice chairman of CBRE Healthcare Capital Markets. “In general, foreign investors are looking to diversify and the U.S. is still considered a safe haven, especially when you consider the geopolitical risks in the other parts of the world.”

Trailing 12-month medical office transaction volume decreased to just less than $12 billion in the second quarter of 2018 but didn’t stray far from the 10-year high of $14.2 billion, according to CBRE.

The real estate investment trust Welltower, for example, recently paid $1.25 billion for 55 medical office and outpatient facilities owned by CNL Healthcare Properties. Most of the 3.3 million square feet of Class A post-acute facilities and specialty hospitals across metro areas of 16 states are affiliated with major health systems.

“Now is a great time to be selling medical office buildings,” Calk said.

“Still, there are three major hurdles to foreign investors eying medical office properties and senior housing facilities—size of the assets, use and sale restrictions, and relationships, Bodnar said. “It requires a lot of manpower to acquire the critical mass of facilities needed to move the needle; a 40,000-square-foot medical office just isn’t going to cut it. These deals also require relationships and trust with major stakeholders. We have seen Chinese firms that are looking at real estate ownership as a possible entry point into partnerships with larger specialty practices.”

Copious Capital

Many large players in healthcare are flush with capital, which is driving expansion, mergers and acquisitions

“Shedding real estate can be attractive to providers that need capital and want to offload maintenance duties as they put more resources into patient care. But cash-rich health systems are not selling their real estate by and large,” said Mindy Berman, managing director of capital markets at JLL.

Source: CBRE research, 2018 Global Investor Intentions Survey

“Despite the burden of technology, labor and pharmaceutical costs, providers are increasingly self-developing new facilities with good access to capital and low borrowing rates, especially for highly rated and high-performing health systems, Mindy Berman said. “Last year was the first year where there were no meaningful monetizations—it goes back to access to capital,” Berman said, adding that she typically sees about two a year.

“The continued strengthening of credit continues to drive a lot of merger-and-acquisition activity and construction,” CBRE’s Bodnar said.

“Many health systems have exercised their right of first refusal, which gives a potentially interested party the right to buy a property before the seller fields any other offers. This is likely an outcome of the low cost of capital,” HRE Cap’s Beebe said.

Despite the momentum around medical office space, the silver tsunami of baby boomers is poised to boost demand for hospitals as well. The push for more micro-hospitalsfeaturing smaller footprints and post-acute facilities, as well as local requirements like seismic upgrades required in California, are driving the current $21.4 billion of new hospital construction, according to JLL. Nearly 38 million square feet of hospital space was under construction in 2018, JLL‘s analysis of Revista data shows. That was up from 25.9 million in 2017, 32.5 million in 2016, 27.5 million in 2015 and 21.4 million in 2014.

“Since the financial crisis, health systems’ access to capital across the spectrum has virtually been unlimited,,” said Jeffrey Sahrbeck, a managing director at healthcare financial advisory firm Ponder & Co. “This will continue to drive M&A and construction activity. Hospitals have been building beds and spending on brick and mortar in advance of baby boomers.”

Source: Modern Healthcare