One Of The Nation’s Biggest Physician Groups To Shed 72 Leases In Six States

One of the largest independent primary care U.S. physician groups is asking a bankruptcy court to reject 72 leases across the country as it restructures its business and reduces debt.

Cano Health, a Miami-based healthcare provider headquartered at 9725 NW 117 Ave. that went public in 2021, has filed for Chapter 11 bankruptcy protection. (PHOTO CREDIT: CoStar)

Miami-based Cano Health just filed for Chapter 11 bankruptcy protection in the District of Delaware after facing financial challenges stemming from its rapid expansion coupled with industry and regulatory headwinds.

The company has received a commitment for $150 million in new debtor-in-possession financing from some of its existing secured lenders to support its operations through bankruptcy proceedings. As the company restructures through the bankruptcy court, it is also exploring opportunities for a sale of all or substantially all of their assets, according to court filings.

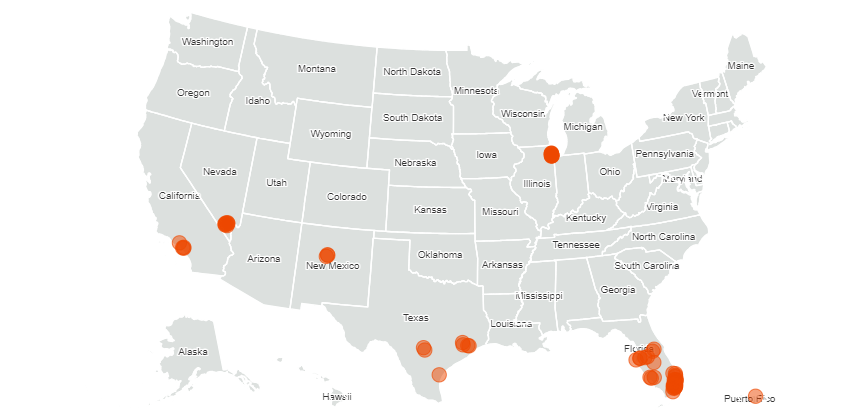

Cano Health is asking the court to reject 72 of what it calls “dark leases,” locations where the company no longer has operations but is still paying rent.

In Florida, the majority of the leases Cano Health wants to reject are concentrated in Miami-Dade, Broward, and Palm Beach counties, with some additional offices and medical centers in the greater Orlando area and Tampa. Other locations include sites in Las Vegas; the Los Angeles area; San Antonio; Houston; Albuquerque, New Mexico; Chicago; and Puerto Rico.

At the end of last year, Cano Health successfully divested operations in Texas and Nevada and exited the California and Puerto Rico markets, according to a company statement.

After considering the revenue, occupancy costs, and capital and business planning variables associated with reopening the closed medical centers associated with the “dark leases,” the company concluded the locations are unlikely to generate significant revenue for the debtors, according to court documents.

Rejecting the dark leases will allow the debtors to “avoid the accrual of unnecessary administrative expenses with no foreseeable benefits to their estates,” the motion said.

“We have taken decisive actions over the past few months to advance our previously disclosed Transformation Plan and strengthen our financial position,” said Mark Kent, CEO of Cano Health, in a press release. “By entering this court-supervised restructuring process, we are positioning the Company to achieve those goals on an accelerated basis.”

Cano Health employed 300 medical providers across 95 medical centers, and maintained affiliate relationships with 630 provider practices as of Feb. 4, according to Kent’s declaration to the court.

Going Public

Cano Health went public in 2021 through a deal with JAWS Acquisition Corp., a special purpose acquisition company led by Barry Sternlicht, chairman and CEO of Starwood Capital Group. The deal raised more than $1.4 billion for Cano Health.

Sternlicht resigned from Cano Health’s board in March 2023 because of a “fundamental disagreement with management” and pushed for the removal of the company’s CEO at the time, Dr. Marlow Hernandez.

Hernandez ultimately stepped down over the summer last year and was replaced with then-chief strategy officer Kent in June on an interim basis before being confirmed in August as the company’s permanent CEO.

Since Kent took the helm, Cano Health has “significantly advanced and accelerated” its strategy to focus on its core lines of business — patients using different types of Medicare, according to the statement. Cano Health expects to achieve $290 million of annualized cost reductions by the end of 2024, the statement said.

Weil, Gotshal & Manges LLP and Richards, Layton & Finger PA are serving as legal counsel for Cano Health in the bankruptcy proceedings while Houlihan Lokey Capital is serving as investment banker and AlixPartners is the company’s financial adviser.

The deadline to file an objection to the proposed lease rejections is Feb. 29 and a hearing over the motion is scheduled for March 7.

Source: CoStar