Why MOBs Offer Healthy Investor Appeal

The health-care sector has largely rebounded from the lockdowns that halted all but the most necessary doctor’s visits and procedures in 2020.

Most health systems reported that they were within 5 percent of pre-pandemic utilization volumes last year, according to Cushman & Wakefield’s most recent healthcare and medical office report.

That’s good news for medical office real estate, as is the expected 7.3 percent growth in outpatient services through 2026, reported Cushman & Wakefield, citing data from the Advisory Board, a healthcare research and analytical organization based in Washington, D.C.

Additionally, medical office buildings have an average occupancy rate of 92 percent, which represents gradual improvement since occupancy dipped in 2020. It’s also clear that while the growth of telehealth fulfilled a need during the lockdown, many ailments and checkups still require an in-person visit. Investors expect MOBs to register 2 percent to 4 percent rent growth this year, according to a JLL survey released in February. That would be consistent with the past two years, which have produced average rent increases of about 2.3 percent, JLL notes, and compares favorably with the 1.9 percent uptick for office rents over the same stretch.

As a result, investors are viewing medical office as a safe haven in a disrupted environment. Not only have rising interest rates cast general uncertainty on property values, but the slow return of employees to the workplace is also raising questions about demand for the office sector as a whole.

“We’re receiving a lot of calls from office owners who are looking for ways to deploy capital into medical office,” said Andrew Milne, senior managing director for JLL Capital Markets. “It isn’t a new trend, but a lot more are rethinking their traditional office portfolios.”

As with most asset categories, higher capital costs have made it challenging to deploy capital into medical office. MOB investors pulled back in the second half of 2022 as the bid-ask spread emerged and lending largely dried up, noted Lorie Damon, an executive managing director with Cushman & Wakefield’s health-care advisory unit. Still, the market remains liquid for trusted borrowers who bring attractive deals to the table.

“The limited capacity for accessing debt right now has certainly impacted medical office as well as every other property sector, but deals are getting done,” said Damon. “Health-care performs really well in recessionary times, because people still get pregnant and still get sick.”

Pressure On Values

Some $19.3 billion in medical office buildings traded in 2022, a $1 billion increase over the prior year, according to New York-based MSCI Real Assets. However, it’s worth noting that a single deal, Healthcare Realty Trust’s acquisition of Healthcare Trust of America, accounted for nearly $8 billion of that total. In the second half of 2022, rising capital costs and recession fears cut MOB transaction volume sharply year-over-year.

Though that REIT deal was a dominant factor in investment volume, private buyers accounted for 72 percent of all transactions in 2022, reported MSCI Real Assets. Health-care REITs pulled out of the market early last year as stock prices fell, observers say. The REITs ended the year down more than 22 percent, according to NAREIT, although they generated total returns of nearly 13 percent in January.

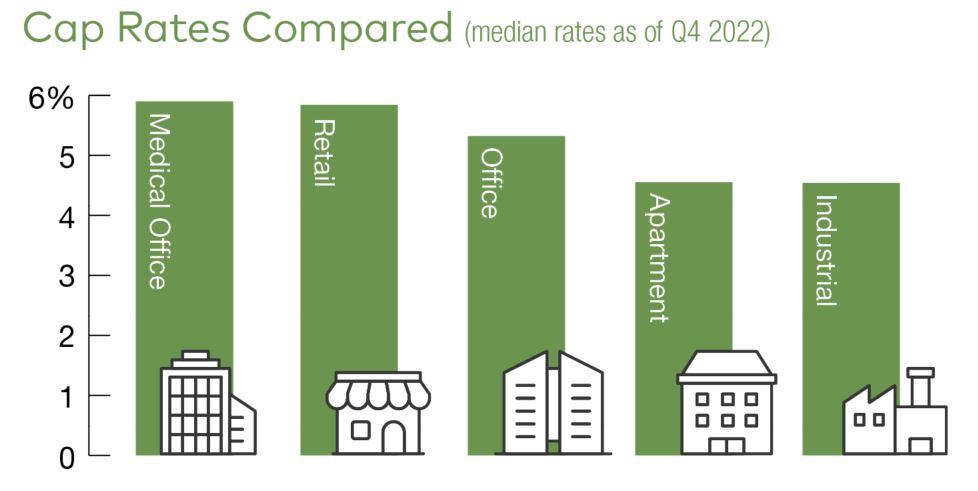

The dive in health-care REIT values further indicates that a repricing is underway and trickling down to the private market. The median cap rate for medical office ticked up to 5.9 percent by the end of the year, according to research by CBRE and Revista. Gauging true value change is difficult, however, because core asset owners who may have wanted to dispose of properties last year ended up holding onto them, limiting the dataset to value-add and core plus transactions, Cushman & Wakefield noted.

“But in San Francisco, cap rates for surgery centers with credit tenants have climbed to as much as 6.5 percent, or about 200 basis points higher than before the pandemic,” said Edward Del Beccaro, executive vice president and the San Francisco Bay Area regional manager with TRI Commercial/CORFAC International.

Many sellers still hope that interest rates will come down and that prior pricing power returns, he added, but he anticipates that the Federal Reserve will raise the benchmark federal funds an additional 100 basis points in 2023.

“Medical office cap rates will be under further pressure to move higher, and I don’t see them going down at all in 2023,” Del Becarro predicted. “But as inflation is tamed and the market settles out, I think medical office will be one of the winners.”

Stabilizing Market

Some observers anticipate a rebound in investment sales activity this year as debt markets stabilize. After some fluctuation during the fall and winter, the yield on the 10-year Treasury reached nearly 4 percent by the end of February. That has generally translated into interest rates between 5.5 percent and 7 percent or more for medical office. Some lenders had reached capacity as last year drew to a close, but lending has ticked up with new allocations for 2023, reported Warren Hitchcock, senior vice president & managing director with Northmarq.

At the same time, the amount of leverage available has dwindled. But some developers can still find favorable terms. A year ago, Hitchcock secured bank financing for 85 percent of cost for a project that was more than 80 percent preleased. Later in the year, a similar deal still managed to muster a loan for 75 percent of cost.

“Not every lender understands medical office,” Hitchcock added. “But the lenders that do know it and understand it are aggressive on it.”

Lender Interest Grows

“Indeed, just as medical office space is attracting a wider group in investors, more lenders are gravitating toward it,” said Lee Asher, vice chairman with CBRE’s Healthcare and Life Sciences Capital Markets. “Among other attractions, medical tenants deliver solid rent coverage thanks to strong earnings before rent costs and other expenses. What’s more, rent makes up only 5 percent of operating expenses for medical tenants, which is typically much lower than occupiers in other property categories. Because physicians want to remain near their patients, tenant retention also tends to be high.”

Meanwhile, on the equity side, medical office assets that come to the market are still fetching multiple offers even though some buyers are still on the sidelines, reported John Chun, a managing director on JLL’s Capital Markets team. But to those investors who are active, the retreat of treasury rates along with a decline in corporate bond spreads and SOFR swap rates (secured financing overnight rate) are providing more certainty to the market than was present just a few months ago.

“It’s still a very fluid and liquid market,” Chun said. “And we’re starting to see all-in interest rates decrease to a level that should benefit medical office deals this year.”

Source: Commercial Property Executive