Health Care Real Estate Could Be A Coronavirus Safe Haven

It’s hard to imagine many stocks will do well through the coronavirus pandemic. But health care stocks and real estate investment trusts tend to be defensive sectors that investors flock to because they pay huge dividend yields.

So what happens when you combine the two?

Health care REITs might be a good bet in this scary market environment. Many are positioned well to help manage the COVID-19 coronavirus crisis, particularly companies that own and operate hospitals, medical offices and life sciences and biotech facilities.

“Health care REITs are generally the most defensive, economically resilient property type in the REIT industry,” said CFRA Research analyst Kenneth Leon in a report last week. “The group offers steady cash flow, low risk of rental rate volatility, and stable occupancy levels.”

Leon said that three in particular that he’s recommending are Alexandria Real Estate Equities (ARE), Healthcare Trust of America (HTA) and Medical Properties Trust (MPW).

Healthy Dividend Yields Are A Big Plus In Uncertain Times

The recent interest rate cut by the Federal Reserve may also help boost health care REITs — and all real estate firms — because of their solid dividend yields.

The three healthcare REITs that Leon recommends pay dividend yields ranging from 2.7% to 5%. With the Fed widely expected to slash interest rates again at its meeting next week, perhaps all the way back to 0%, the income that REITs generate will become even more tantalizing to investors flocking to safe havens.

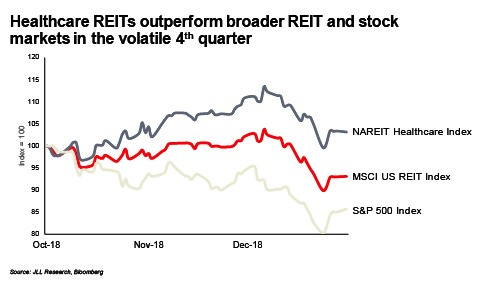

“While COVID-19 has created near-term economic uncertainty, the REIT industry’s strong earnings, solid balance sheets, and high occupancy rates demonstrate that they are entering this situation well-positioned to handle a potential economic slowdown,” said Steven A. Wechsler, president and CEO of the Nareit trade group.

Senior Living Centers Look Risky

But not all health care real estate firms will thrive. Leon thinks investors should avoid companies that run senior living centers, because they won’t be able to safely show their properties to prospective new residents. He noted that many went into lockdown mode during the flu season of late 2017 and early 2018. And the COVID-19 outbreak is even scarier.

“Coronavirus may limit senior housing operators from showing their properties to prospective residents,” Leon wrote. “Precaution is a top priority for health care operators to better control an elevated death rate from severe flu conditions for the elderly.”

“Operators cannot conduct visitor tours and sign up new residents.

Senior housing is in effect quarantined to new prospective residents and their families,” Leon wrote.

Source: CNN Business